We’re well aware of how popular Cherry Mobile is in the Philippines, but we couldn’t quite put it into numbers, given how secretive consumer-electronics companies usually are when it comes to sales and profits. That is, until now.

Research firm IDC today released its Asia-Pacific Quarterly Mobile Phone Tracker, ranking Cherry Mobile as the top mobile vendor in the country in 2014, with a staggering 21.9 percent market share of the total smartphones shipped last year. Samsung came in a far second with 13.3 percent, while MyPhone, Lenovo, and Torque placed third, fourth, and fifth with 11.2 percent, 6.5 percent, and 4.8 percent market share, respectively.

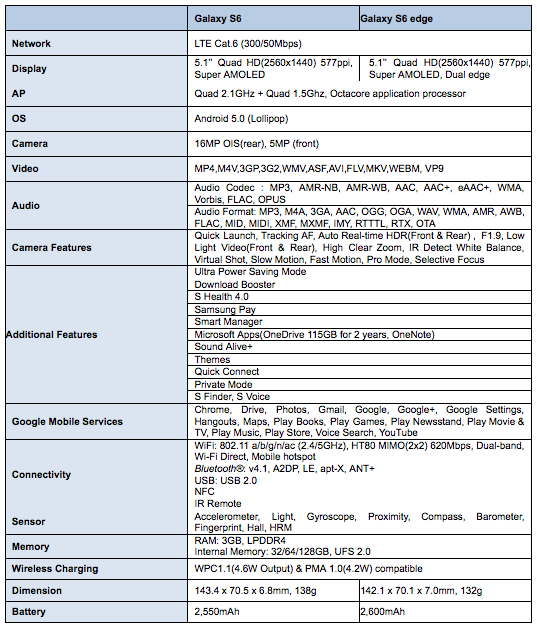

[frame src=”https://www.revu.com.ph/wp-content/uploads/2015/03/Top-Philippine-Smartphone-Brands-2014.png” target=”_self” width=”620″ height=”412″ alt=”Premium WordPress Themes” align=”center” prettyphoto=”false”]

Chart culled from IDC

The report also revealed that a total of 26.8 million handsets were shipped last year, and out of that incredible number, smartphones accounted for 47 percent of the tally, up from 24 percent in 2013. IDC has attributed the continued rise in mobile ownership to cheaper prices and manufacturers focusing more on their smartphone efforts.

The third quarter of 2014 marked the first time smartphone shipments surpassed those of feature phones. And the gap will only widen. According to IDC, the Philippine smartphone market will see a 20 percent year-over-year growth in 2015 as feature-phone sales continue to decline sharply. (RL)

ALORA UY GUERRERO’S TAKE: I’ve said it before, and I’ll say it again: Pinoy brands will rule the Philippine smartphone market for quite some time. Offering decent-looking devices with mid-end specs at low prices is a recipe for market-share dominance in a country where 24.9 percent of the population is below the poverty line. So I’m not really surprised by the result.

I’m not surprised by the result. What I’m more interested in is the list that reveals the brands that are slugging it out in the profits department.

What I’m more interested in is the list that reveals the brands that are slugging it out in the profits department. Take note that the IDC report only refers to the number of smartphones shipped. Are the top-ranking companies in the study making boatloads of cash, or are they just a little over breaking even?

Can the king of profits in the Philippines please stand up?

RAMON LOPEZ’S TAKE: At this point, I don’t think there’s any denying that Cherry Mobile is the country’s top smartphone brand, at least as far as total units shipped is concerned. I mean, just look at how many Cherry Mobile kiosks have popped up in Metro Manila alone. Even more telling than Cherry Mobile’s nationwide distribution network is how busy the stores usually are. And things only get wilder whenever the company, which has been in the trenches of the mobile-price war for so long, releases a new budget device that threatens to keep industry execs awake at night.

Price remains a major motivator for the local market, and when it comes to selling low-priced handsets and tablets, Cherry Mobile owns the formula for success.

Unfortunately for the competition, I haven’t seen anything to indicate change is in the air. Price remains a major motivator for the local market, and when it comes to selling low-priced handsets and tablets, Cherry Mobile owns the formula for success. Whether relying on scale to compensate for thin margins will remain a profitable strategy moving forward is a question for another day.