Estimated reading time: 2 minutes

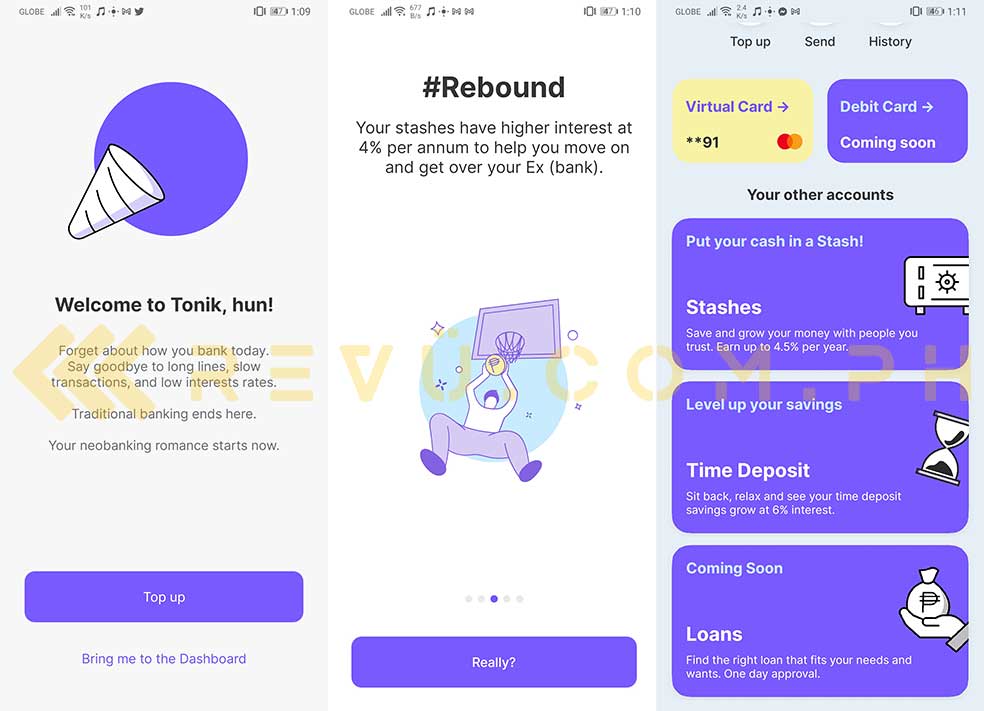

There’s a new all-digital bank in town. Tonik has officially launched in the Philippines, with plenty of great features in tow, including individual or group stashes that can earn up to 4.5% per year and time-deposit savings you can grow at an impressive annual interest of 6%.

SEE ALSO: BDO Pay: How to set it up on your smartphone

Users automatically get a virtual Mastercard for online purchases and payments upon registration, but physical debit cards will be offered in the future as well. Tonik will even let you borrow money with one-day approval within the app sometime soon. Best of all, registering for a Tonik account is free and can be accomplished in seconds via your smartphone. You can download the app today on the Google Play Store and App Store.

If you already have an account set up on your device or you’re still on the fence about signing up, you may want to read the rest of this article to know the top-up and send/transfer options Tonik offers in the Philippines at launch. Take note that all top-up options have zero transaction fees — yes, zero! — at the moment.

Top-up options

- Local bank transfer (coming soon)

- Debit card via Visa, Mastercard, or JCB: Transaction limits are based on the limit set at the card-issuing bank

- Online

- GCash: Up to P100,000

- BPI: Up to P50,000

- Coins.ph: Up to P10,000

- UnionBank: Up to P250,000

- Over-the-counter

- CLIQ: Up to P5,000

- 7Eleven (7connect) – Up to P450,000

- Cebuana: Up to P25,000

- MLhuillier: Up to P25,000

- SM Payment: Up to P450,000

Send/transfer options

- Bank transfer via Instapay: No transaction fee

- GCash: No transaction fee

- Other Tonik users (via mobile number or Tonik account number): No transaction fee

- Over-the-counter

- Cebuana: Up to P30,000, P50 transaction fee

- MLhuillier: Up to P30,000, P50 transaction fee

Share this Post