Which smartphone brands did well in the Philippines in the second quarter of 2018? What was the local smartphone market like from April to June this year?

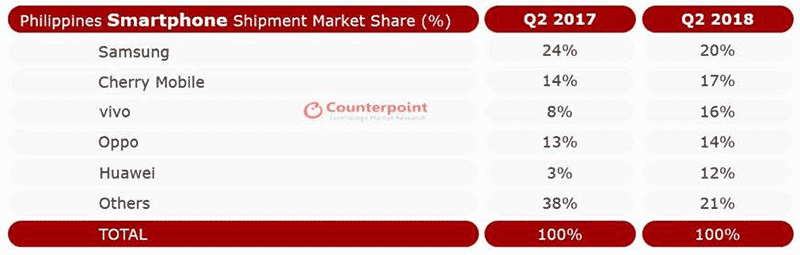

According to market-research firm Counterpoint, three of the top five vendors in the country were Chinese brands — Vivo, OPPO, and Huawei. In fact, the trio accounted for around 45 percent of the Philippine smartphone market and led to a significant decline of local brands such as MyPhone and CloudFone.

Vivo, OPPO, and Huawei accounted for around 45 percent of the Philippine smartphone market and led to a significant decline of local brands such as MyPhone and CloudFone.

Of the three, fifth-placer Huawei was the manufacturer that grew the most, with its market share ballooning from 3 percent in the same period in 2017 to 12 percent this year. That’s equivalent to an increase of at least 400 percent. The brisk sales of the Huawei Y6 and Nova 2 Lite contributed to its phenomenal growth. Take note that this is Huawei’s first time to enter the top five.

The second biggest gainer was Vivo, which landed third last quarter. Its market share surged 106 percent year-on-year, thanks to the success of the Vivo Y53 and Y71.

In fourth place was OPPO, whose F7 and A83 smartphones were a hit among consumers in the Philippines. It was stable at 14 percent, slightly higher than 2017’s 13 percent market share.

South Korea’s Samsung and the Philippines’ own Cherry Mobile took the first and second spots. The former captured nearly one-fifth of the total smartphone market, due largely in part to the Galaxy J series, which contributed to over 68 percent of Samsung’s total shipments for the Philippines. The latter’s position, on the other hand, was driven by sales of models like the Flare S6 and J3. The two brands still had a strong hold on the local market, especially in rural areas.

But unfortunately for Samsung, its 20 percent market share in the second quarter is actually lower than last year’s 24 percent. As for Cherry Mobile, it had to focus on the sub-$99 (sub-P5,326) price segment, mainly because of the Chinese manufacturers’ aggressive approach in the mid-tier price segments.

The Philippine smartphone market recovered from weak smartphone sales in the first three months of 2018, recording a 9 percent growth year-on-year last quarter. However, the overall handset market declined 6 percent year-on-year, owing to a steep decline in the feature-phone segment, Counterpoint revealed. Its research shows that 76 percent of the total handsets sold in the Philippines last quarter were smartphones.

For more on Counterpoint’s report, go to this page.

Share this Post