The smartphone market in the Philippines continued its growth streak for the second year in a row, despite facing challenges such as the weakening peso and unpredictable weather.

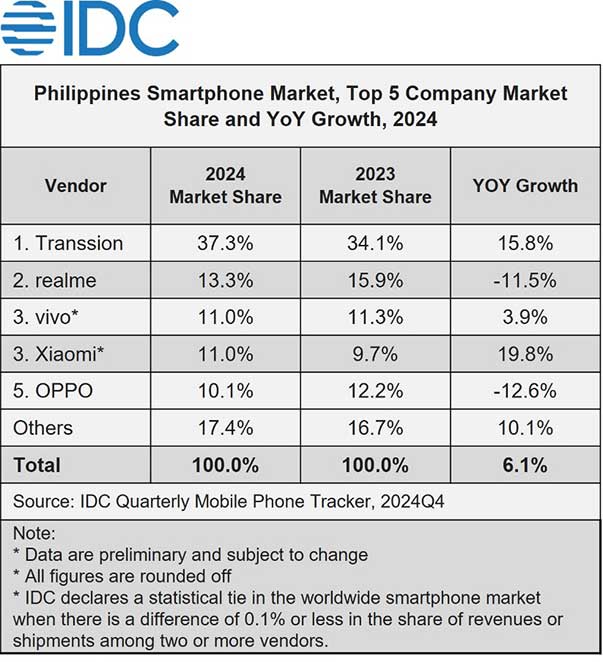

According to preliminary data from the International Data Corporation, 2024 saw a year-over-year growth of 6.1%, with nearly 18 million units sold. The solid economic growth of the country and the strategic push by vendors to introduce more entry-level models played a significant role in this expansion.

A noteworthy point from the IDC report is that more than half of the smartphones shipped in 2024 were priced below $100 (under ₱5,817). Transsion Holdings, with its brands TECNO, Infinix, and Itel, led this category by delivering over 4.8 million units. The TECNO SPARK Go and Infinix SMART lineups were particularly popular, contributing to a drop in the average selling price from $192 (₱11,169) in 2023 to $179 (₱10,413) in 2024.

Transsion claimed the top spot with a 37.3% market share, followed by realme at 13.3%, vivo and Xiaomi both at 11%, and OPPO rounding out the top five with a 10.1% share. Despite a slowdown in the last quarter due to early launches by vendors in the preceding quarter, the fourth quarter still managed to be the strongest for smartphone shipments, driven largely by the holiday season.

Southeast Asia’s smartphone shipments up 11% in 2024 as OPPO takes lead for first time

— Canalys (@Canalys) February 11, 2025

The market rebounded in 2024, with vendors shipping 96.7 million units – up 11% year on year after two years of decline.

Read the full report – https://t.co/MBPHRGVMKH pic.twitter.com/6twbfYJPp5

At the top center: top vendors’ performance in the Philippines according to Canalys this time. Out of topic: Interestingly, OPPO topped the Southeast Asian market for the first time ever

Another research firm, Canalys, also reported that Transsion maintained its leading position with a 34% market share. While specific market-share breakdowns for its three brands were not available, TECNO emerged as the primary driver of Transsion’s growth in the third quarter.

Xiaomi and vivo both held a 15% share, with realme close behind at 11%, and OPPO at 10%. The consistency in the rankings from both IDC and Canalys reflects the competitive nature of the smartphone market in the Philippines, with brands constantly innovating to capture Filipinos’ interest.

Share this Post