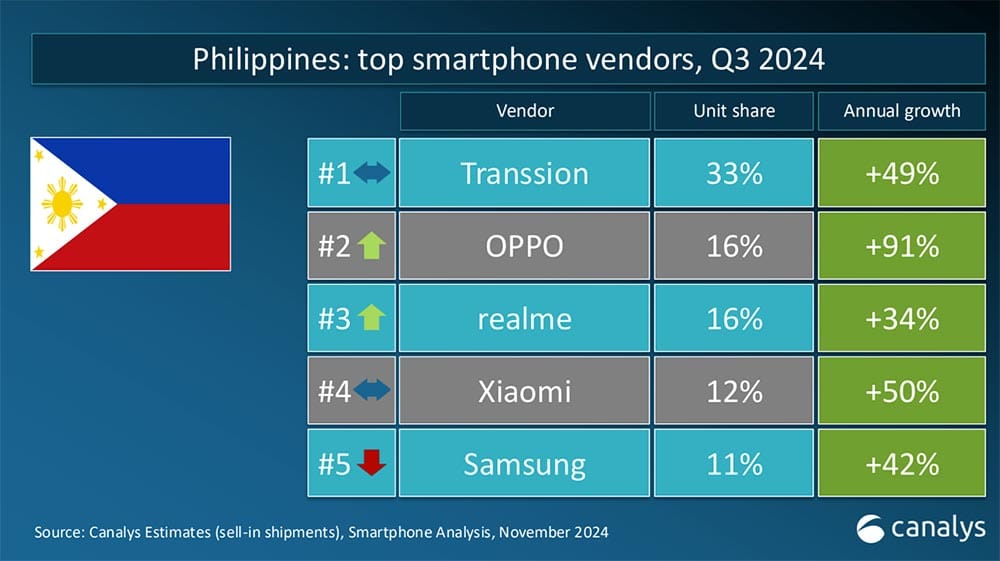

Transsion once again emerged as the leading smartphone vendor in the Philippines.

The Q3 2024 data, released in this month’s Canalys Smartphone Analysis report, reveal a significant shift in the country’s competitive landscape, with Chinese brands asserting their dominance.

Transsion’s rise to the top spot pushed aside established players like Samsung, which now occupied the fifth position. OPPO, realme, and Xiaomi also secured their places in the top 5.

The Chinese conglomerate, Transsion, continued its domination of the Philippine smartphone market, thanks to its trio of budget-friendly brands: TECNO, Infinix, and Itel. Holding tight to the top spot in the third quarter, Transsion commanded a 33% market share, boasting a significant 49% annual growth.

OPPO exploded onto the local scene in Q3 2024, capturing the second spot in the country’s smartphone market with a 16% share. This impressive feat is largely attributed to the brand’s A Series, offering a compelling blend of durability and affordability that clearly resonates with Filipino consumers.

Canalys’ latest report reveals a staggering 91% annual growth for OPPO, a figure underscoring the brand’s strategic success last quarter. Interestingly, OPPO shared its 16% market share with realme, which landed in third place. While the report rounded off the numbers, it’s safe to assume a photo finish between these two brands, likely decided by mere decimal points.

Interestingly, OPPO achieved a staggering 91% annual growth, a figure underscoring the brand’s strategic success last quarter

Xiaomi maintained its position in the top 5, securing a 12% market share. However, Samsung’s struggles became increasingly apparent as the tech giant slipped to fifth place with an 11% share.

Adding to the drama, BBK Electronics brand vivo was ousted from the top 5, a testament to the volatile nature of the Philippine market.

However, it’s crucial to remember that these numbers are based on sell-in shipments, meaning the volume of devices shipped from the brands to distributors and retailers, not actual sales to consumers. So while this data provides valuable insight into market dynamics, it doesn’t necessarily equate to units flying off the shelves.

The question remains: Will this sell-in success translate into actual consumer demand? Only time will tell if these companies can maintain their momentum in the cutthroat Philippine smartphone arena.

Share this Post