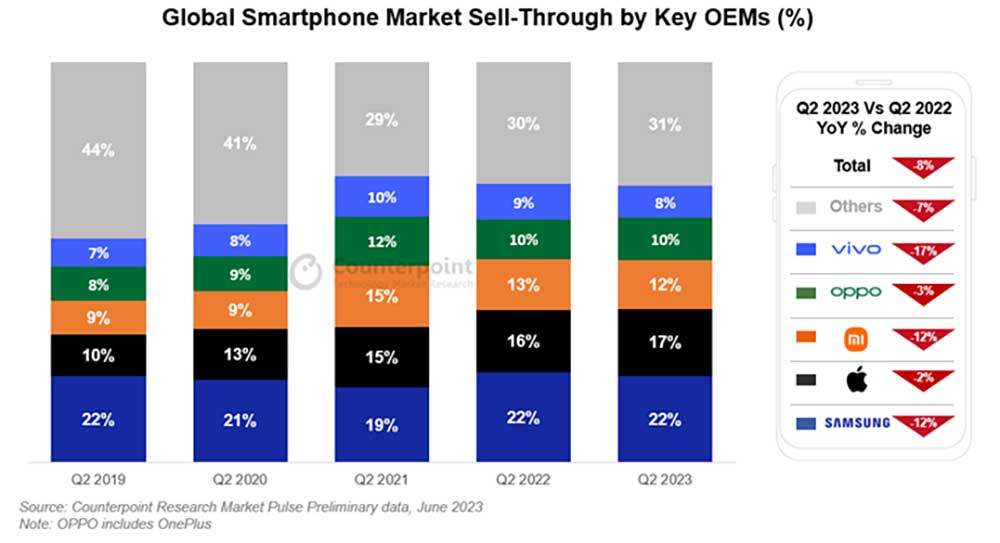

The global smartphone market fell in the second quarter of 2023, marking the eighth consecutive quarter that it experienced a year-on-year decline.

According to the latest research from Counterpoint’s Market Pulse service, the worldwide sell-through dropped 8% YoY and 5% QoQ last quarter. This indicates the international smartphone market could be past its rapid-growth phase. The market-analyst firm said consumers don’t replace their units with new ones immediately, there’s already convergence in device innovation, and a more mature refurbished market for handsets has emerged.

Among the top 5 smartphone vendors, only second-placer Apple saw its share increase from the same period last year, recording its highest-ever Q2 market share at 17% despite unfavorable seasonal factors. In fact, Apple achieved record shares in several new markets that are typically not considered its core markets, such as India, where it grew 50% YoY in Q2 2023. It benefited from the trend of consumers opting for phones from the premium segment, the only category to have grown from April to June.

However, Samsung still topped the smartphone market with its 22% share courtesy of its Galaxy A series models’ strong performance globally.

Third-placer Xiaomi didn’t do well in its biggest markets — China and India — and is said to “offset such declines with expansion in other markets and by refreshing its portfolio.” Fortunately for OPPO, those same two markets helped it retain the fourth spot with an unchanged 10% share even though it registered losses in Western Europe. It had its sub-brand, OnePlus, to thank for its performance last quarter.

Rounding out the top 5 was vivo — including its subsidiary, iQOO. According to Counterpoint, the company saw major growth declines in China after a strong Q2 last year as well as strong competition from Samsung, and OPPO in the offline markets of India and Southeast Asia. You can read the full report here.

Share this Post