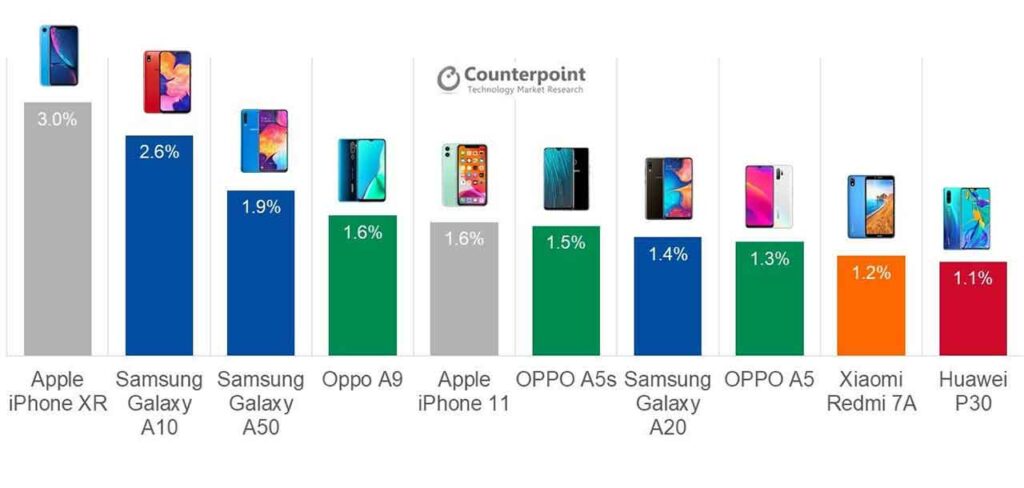

A new Counterpoint Research report names the Apple iPhone XR as the best-selling smartphone in the third quarter of 2019, taking 3% of the worldwide market share.

More than a year since its launch in September 2018, the iPhone XR has consistently been the top-selling smartphone every quarter since Q4 2018. The only time it didn’t rank was during its launch quarter.

According to the market research firm’s Market Pulse, Apple adjusted the price of the entry-level flagship phone in China and several other markets to maintain the demand for the device.

While it wasn’t able to overtake the iPhone XR, the new Apple iPhone 11 made its way into the top 10 as well, coming in fifth place with a 1.6% market share. Unlike the iPhone XR, the iPhone 11 did debut in the top 10 within its launch quarter, but it is the only other Apple handset in the ranking.

SEE ALSO: Apple dominates with 66% share of phone profits in Q3 2019

Samsung and OPPO each have three smartphones on the list, and all of them carry the A series brand. Another thing the two companies have in common is that the said devices belong to the midrange category. None of their flagship phones made the list.

Samsung’s Galaxy A10, Galaxy A50, and Galaxy A20 placed second, third, and seventh, with 2.6%, 1.9%, and 1.4% market share, respectively. After discontinuing its J line, the Samsung A series brought more premium features into a more budget-friendly price range, giving consumers an excellent value proposition for these handsets.

The OPPO A9, OPPO A5s, and OPPO A5 placed fourth, sixth, and eighth on the list, with a market share of 1.6%, 1.5%, and 1.3%, respectively.

The world’s top 10 bestselling smartphones in Q3 2019

The Xiaomi Remi 7A came in at number nine, with a 1.2% market share. Its inclusion was driven by sales in India, which contributed over half of its total sales in the quarter.

The Huawei P30 rounded out the list with a 1.1% market share. It’s the last Huawei flagship smartphone with Google Mobile Services. If GMS isn’t restored in future devices, we might not see Huawei handsets in the top 10 moving forward — at least in the next few quarters.

The volume contribution when it comes to total sell-through for the 10 phones combined achieved a 9% increase year-on-year, capturing a total sales of 17% compared to 15% in Q3 2018. But combined wholesale revenue plunged by 30% year-on-year due to the increasing number of midrange devices in the list. There are only three premium models this year when compared to the five that got in the ranking in the third quarter of last year.

READ ALSO: Xiaomi issues statement on ‘top phone brands in the Philippines’ report and How OPPO is preparing for the 5G era in Asia-Pacific

Smartphone manufacturers have been bringing more premium features into the midrange market, and in some cases, even introducing said features to this market ahead of bringing them to premium phones. These devices then become more attractive to consumers.

As Counterpoint reported, the Samsung Galaxy A50 sports a triple camera setup (25-megapixel + 8-megapixel + 5-megapixel), a 25-megapixel front shooter, a 6.4-inch screen, and an in-display fingerprint sensor. At the same time, the Samsung Galaxy S9, the flagship from a year ago, has a single 12-megapixel rear camera, an 8-megapixel front camera, a rear-mounted fingerprint sensor, and a 5.8-inch screen.

Boosting revenue continues to be tricky for smartphone manufacturers to navigate. The total global handset industry has experienced an 11% decline to $12 billion in the third quarter of 2019. Apple still dominated over its competition in this quarter, as we’ve previously reported.

Main image via iNews

Share this Post